Newmark Knight Frank negotiates $44 million acquisition loan for Arden Group

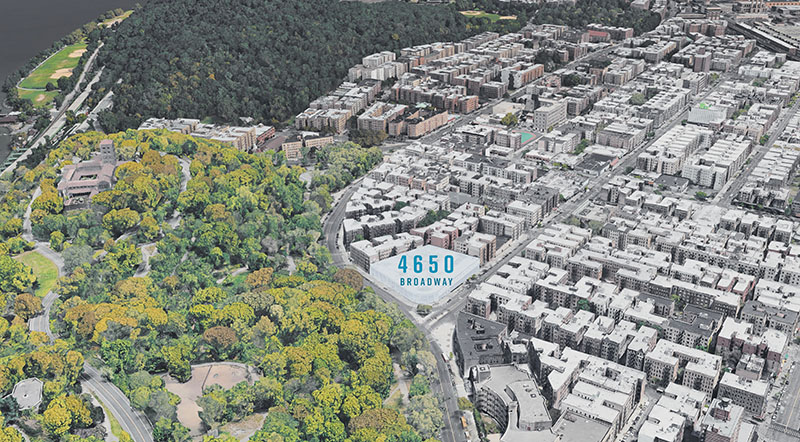

Manhattan, NY On behalf of Arden Group, Newmark Knight Frank has arranged a $44 million floating-rate loan for the acquisition of 4650 Broadway, a development site located in the Inwood neighborhood.

Newmark Knight Frank vice chairmen and co-heads of debt & structured finance Dustin Stolly and Jordan Roeschlaub, worked with Arden Group, along with Nick Scribani, Chris Kramer, Seth Hall, and Ryan Flannery. The loan was provided by SCALE Lending, the lending arm Martin Nussbaum’s and David Schwartz’s Slate Property Group.

Newmark Knight Frank vice chairmen and co-heads of debt & structured finance Dustin Stolly and Jordan Roeschlaub, worked with Arden Group, along with Nick Scribani, Chris Kramer, Seth Hall, and Ryan Flannery. The loan was provided by SCALE Lending, the lending arm Martin Nussbaum’s and David Schwartz’s Slate Property Group.

4650 Broadway is a 47,350 s/f development site near Fort Tryon Park and the A and 1 subway lines. The contemplated development will feature 300,000 s/f of both market rate and affordable residential units, above and below grade retail and community facility space. The property also features an Opportunity Zone designation.

“Arden Group has identified a compelling development opportunity that is within a growing submarket in Manhattan and has secured the site at an attractive basis,” said Stolly.

“With ample light and air, access to abundant area amenities, and convenient transportation options, Arden Group will bring a new mixed-use, class A development to the Inwood area,” said Roeschlaub.

Arden Group is a privately held, vertically-integrated real estate fund manager, investor and operator that owns and finances properties across the United States. Since the company’s founding in 1989 by Craig Spencer, Arden Group has managed more than $8 billion of real estate assets and acquired and/or developed more than $4 billion of properties through joint ventures and discretionary investment funds. Arden Group is focused on investing in and lending to value-add properties located in larger U.S. markets with demonstrated positive demand factors and historic market resiliency.