Qualified Improvement Property (QIP) has undergone a number of changes over the years and is currently at the center of a major controversy following a drafting error in the Tax Cuts and Jobs Act (TCJA). Without QIP as we know it, what other tax saving strategies can real estate owners and investors implement?

The Protecting Americans Against Tax Hikes (PATH ACT) introduced QIP, starting with 2016 tax returns, to provide additional tax savings for real estate owners and investors. QIP was defined as any improvement to an interior portion of a building which is non-residential real property, as long as the improvement was placed-in-service after the date the building was first placed-in-service. A building’s enlargement, elevators and escalators and internal structural framework were all excluded from this definition. Under the PATH Act, QIP was not subject to as many limitations as its predecessors (QLI, QRP, QRIP) and as of 1/1/2016 QIP became the only property category eligible for bonus depreciation.

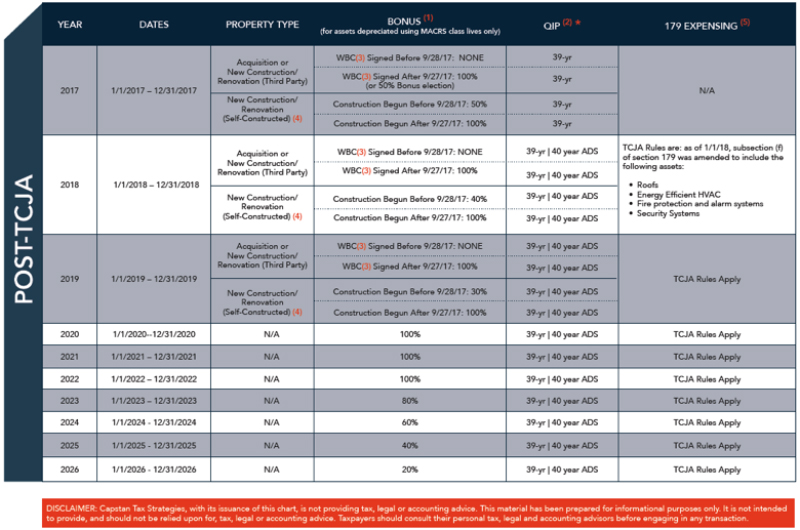

Currently under the TCJA, QIP is not eligible for bonus depreciation due to the aforementioned drafting error, and this will remain the case unless or until congress issues a technical correction. The architects of the TCJA intended to create a “new QIP,” which would boast both a short recovery period of 15 years AND a broad, easy-to-meet definition. However, while the authors eliminated the categories of QLI, QRI, and QRIP, and created the “new QIP,” they never actually changed the associated recovery period. As a result, QIP has a 39-year class life, and therefore, is not eligible for bonus depreciation. So, what can real estate owners and investors do now? Bonus-eligible QIP was a very powerful incentive, and many professionals are missing it already. But not all is lost. There are other tax savings opportunities that may be employed in place of bonus-eligible QIP, and are relatively easy to implement as part of a thoughtful and comprehensive tax plan.

Currently under the TCJA, QIP is not eligible for bonus depreciation due to the aforementioned drafting error, and this will remain the case unless or until congress issues a technical correction. The architects of the TCJA intended to create a “new QIP,” which would boast both a short recovery period of 15 years AND a broad, easy-to-meet definition. However, while the authors eliminated the categories of QLI, QRI, and QRIP, and created the “new QIP,” they never actually changed the associated recovery period. As a result, QIP has a 39-year class life, and therefore, is not eligible for bonus depreciation. So, what can real estate owners and investors do now? Bonus-eligible QIP was a very powerful incentive, and many professionals are missing it already. But not all is lost. There are other tax savings opportunities that may be employed in place of bonus-eligible QIP, and are relatively easy to implement as part of a thoughtful and comprehensive tax plan.

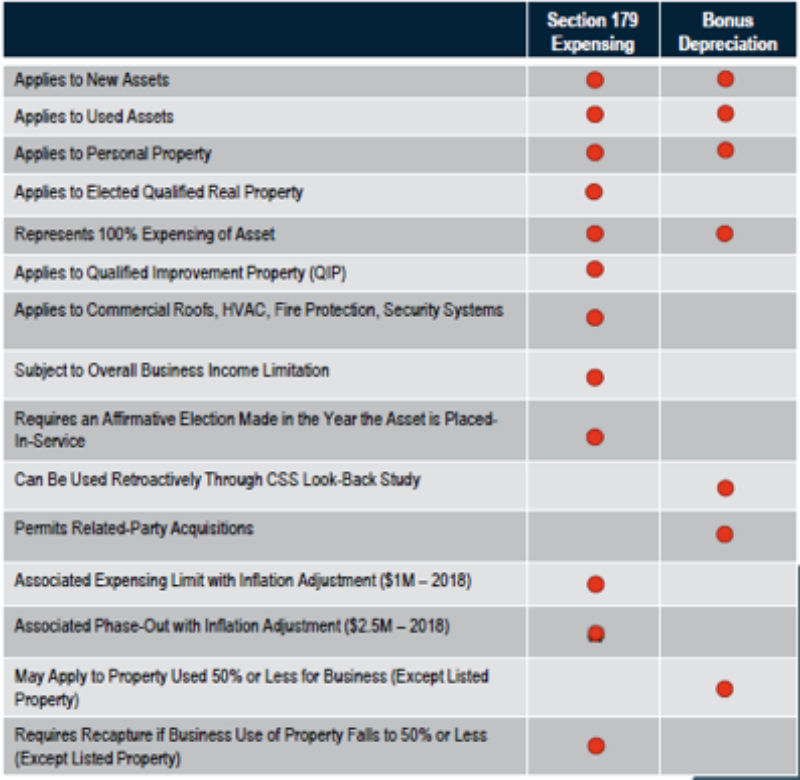

Section 179 expensing is just one other opportunity worth considering. The TCJA expanded Section 179 eligible assets to include QIP, roofs, HVAC systems, fire protection and alarm systems, and security systems, provided these improvements are made in non-residential buildings and are placed-in-service after the building was placed-in-service. Now that QIP is eligible for 179 expensing, QIP brings new value to the table. Even without bonus, QIP can be useful as a way to highlight Section 179-eligible assets. Eligible assets may be new or used and for the first time, assets found in lodging facilities are eligible. Now hotels, motels, and dormitories can take advantage of 179 expensing for personal property. There is, however, a limit of $1 million in 2018 and $1.02 million in 2019 for 179 expensing. Section 179 is an entity-level election that must be elected in the year the asset is placed-in-service. The table presents points to consider when comparing Section 179 expensing and 100% bonus depreciation.

As a commercial property owner or investor these tax strategies may be daunting. In order to take advantage of QIP now and in the future, a cost segregation study is key. Having a cost segregation study performed on any renovation, new construction, or acquisition allows the real estate owner to take full advantage of bonus depreciation and Section 179 expensing. Unless or until congress passes a technical corrections bill, QIP will remain ineligible for bonus depreciation and remains a 39-year asset. When a cost segregation study is completed some assets will be segregated into 5, 7, or 15-year class lives. These short-lived assets may be eligible for 100% bonus depreciation.

As a commercial property owner or investor these tax strategies may be daunting. In order to take advantage of QIP now and in the future, a cost segregation study is key. Having a cost segregation study performed on any renovation, new construction, or acquisition allows the real estate owner to take full advantage of bonus depreciation and Section 179 expensing. Unless or until congress passes a technical corrections bill, QIP will remain ineligible for bonus depreciation and remains a 39-year asset. When a cost segregation study is completed some assets will be segregated into 5, 7, or 15-year class lives. These short-lived assets may be eligible for 100% bonus depreciation.

There are many ways to make the most of the of the tax savings strategies available while QIP is not eligible for bonus depreciation. The TCJA has created many opportunities for tax savings for commercial real estate owners and you should consult your CPA and tax experts to make certain that you are fully leveraging strategies new and old.

Since their inception, bonus and 179 expensing have competed with one another. Now with their expanded definition and eligibility, this competition will be even more acute. As a result, it is critical to be sure to review the benefits and drawbacks of each strategy prior to tax filing. As always, the age old adage “it depends” will be in play.

Carly Ferris is a regional director at Capstan, Greenwich, CT.