Ariel Property Advisors shares “Multifamily Year in Review NYC 2017” - by Shimon Shkury

New York, NY The New York Real Estate Journal recently sat down with Shimon Shkury, founder and president of Ariel Property Advisors, a New York City investment real estate services and advisory company, who shared some of the highlights from Ariel Property Advisors’ “Multifamily Year in Review 2017.”

Q: How did the multifamily market perform in 2017?

Q: How did the multifamily market perform in 2017?

A: While pricing was a notable bright spot, particularly in Queens, the Bronx and Northern Manhattan, volume in the New York City multifamily market slumped to levels not seen since the beginning of the decade, due largely to a dramatic pullback in institutional-level transactions. Dollar volume reached a six-year low amid the fewest number of transactions since 2010.

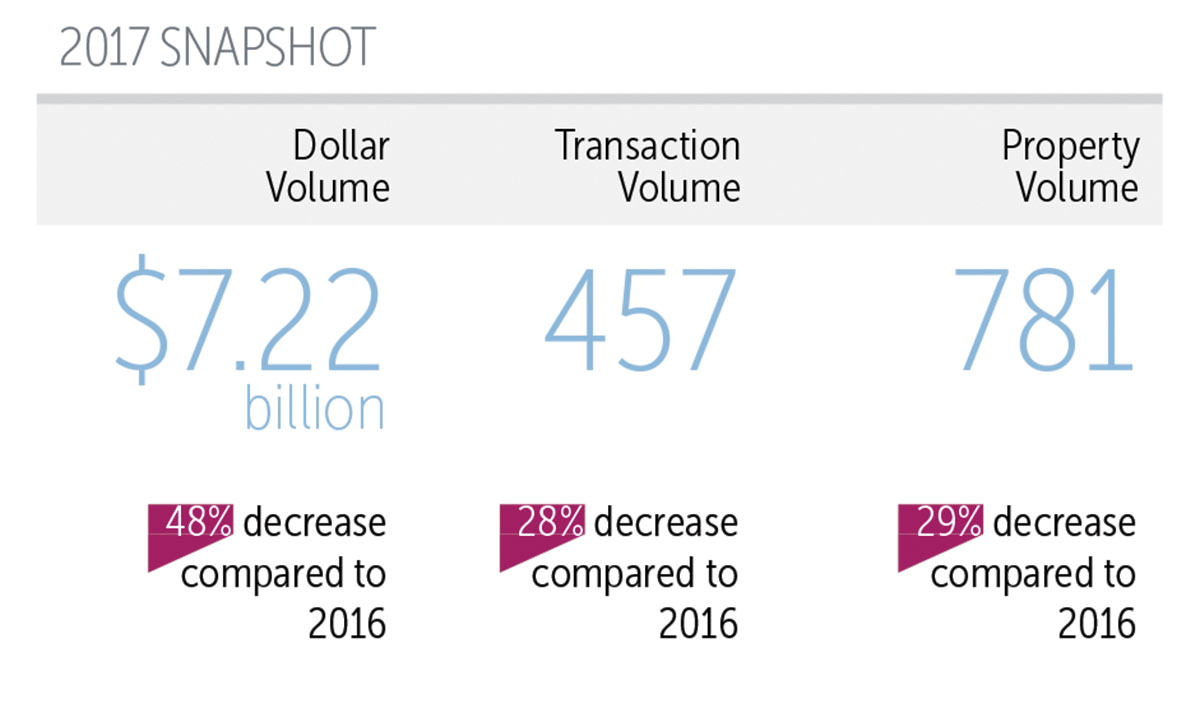

Investor optimism about the asset emerged mid-year, and accelerated during the third and fourth quarters, but it was not enough to offset palpable weakness early in 2017. Overall, the city saw $7.22 billion in multifamily sales take place across 457 transactions and 781 buildings. When compared to 2016, dollar and transaction volume declined 48% and 28%, respectively, while property volume slid 29%.

Institutional investors were largely absent in 2017. New York City recorded only five sales at or above $100 million, down sharply from 26 sales the previous year. The largest sale of the year clocked in at $135 million, a level that was surpassed seven times in 2016 and four in 2015, when the largest sale in those years were $620 million and $5.5 billion, respectively.

From a macroeconomic perspective, a strengthening U.S. economy is helping the Federal Reserve edge closer to its goal of returning monetary policy to pre-crisis levels. Policymakers raised interest rates three times last year and they have signaled plans to raise them three more times in 2018. On a local level, the rental market faced well-publicized struggles last year, with median rents in Manhattan and Queens falling, while they remained flat in Brooklyn.

Q: How did multifamily prices hold up in 2017?

A: The Bronx saw the most sizeable price appreciation. Pricing metrics stood as follows (year-over-year changes):

• Price per s/f at $196 (+8.3%);

• Price per unit at $175,503 (+9.9%);

• Capitalization rate at 4.94% (-5%); and

• Gross rent multiple at 11.89 (+7.5%).

Prices in Manhattan softened slightly. Pricing metrics stood as follows (year-over-year changes):

• Price per s/f at $945 (-1.5%);

• Price per unit at $669,315 (-1.2%);

• Capitalization rate at 3.61 (+2.4%); and

• Gross rent multiple at 19.49 (-1.3%).

Brooklyn saw mixed pricing. Pricing metrics stood as follows (year-over-year changes):

• Price per s/f at $388 (+3.2%);

• Price per unit at $316,692 (-4.2%);

• Capitalization rate at 4.43% (1.12%); and

• Gross rent multiple at 15.39 (+4.9%).

Pricing in Northern Manhattan firmed. Pricing metrics stood as follows (year-over-year changes):

• Price per s/f at $382 (+7.3%);

• Price per unit at $320,729 (+3.81%);

• Capitalization rate at 4.08% (+4.62%); and

• Gross rent multiple at 15.24 (+5.9%).

Queens saw varied pricing. Pricing metrics stood as follows (year-over-year changes):

• Price per s/f at $371 (+9.4%);

• Price per unit at $282,834 (+2.4%);

• Capitalization rate at 4.25% (-0.7%); and

• Gross rent multiple at 15.31 (+2.3%).

Q: How did the submarkets perform last year?

A: On a sub-market level, Manhattan struggled in 2017, with volume metrics decreasing substantially from the previous year’s levels. The borough’s dollar volume, at $2.32 billion, was the lowest since 2010, and its 57% drop from 2016 was the sharpest decline of any sub-market.

Northern Manhattan fared well from a pricing perspective, but a dearth of institutional-level transactions versus the previous year took a sizable toll on dollar volume, which fell 47% to $1.36 billion. Indeed, the sub-market saw only one transaction that exceeded $100 million versus six transactions of that size in 2016.

In the Bronx, volume, echoing the trend throughout the city, slumped, although the declines were less pronounced than other sub-markets. The borough recorded 102 transactions consisting of 170 buildings sold for an aggregate consideration of $1.21 billion. That represents a 29% and 33% drop in transaction and building volume, respectively, but a relatively modest 12% slide in dollar volume.

Brooklyn’s multifamily market softened, with volume metrics notching double-digit declines. Dollar volume slumped 48% to $1.48 billion, transaction volume slid 35% to 119, and building volume sunk 21% to 227.

Queens activity was extremely lackluster in 2017, with transaction volume skidding 40% to 43%, the steepest year-over-year decline of any sub-market. At the same time, dollar volume dropped 47% to $849 million, making Queens the only sub-market to register less than $1 billion in sales for the year. This drop-off in sales, however, was largely a function of severely strained inventory rather than pricing.

On a neighborhood level, the Upper East Side was the most active area in Manhattan in 2017, with the area registering 27 transactions that sold for $331.76 million. In Northern Manhattan, Washington Heights led the way with $693.84 million in sales.

In Brooklyn, dollar volume was dominated by the neighborhood of Brooklyn Heights, which notched $193.3 million in sales across seven transactions. The neighborhood of Bedford-Stuyvesant also fared well, with $150.7 million in sales. In the Bronx, Melrose topped dollar volume, with $165.90 million in sales, and Flushing-North ruled Queens, recording $183.78 million in sales.

Q: What do you see on the horizon for the multifamily market this year?

A: We think volume in 2018 will see a slight uptick from 2017. Not significantly, but there will be more trades and more dollar volume. Looking back, 2017 was an event-driven and “wait-and-see” type of year, but there is more clarity in the market right now than there was this time last year.

Investors appear to be approaching 2018 with a firmer grasp of the risks and rewards that today’s market presents, which should translate to more deal flow. Sellers and buyers are becoming more realistic with their pricing expectations and the new tax policy should help multifamily property owners. We are also seeing institutional investors looking at larger assets again.

Pricing will be a mixed-bag, but some locations will continue to increase in value, while others will plateau. However, we don’t expect a big drop-off in pricing anywhere in New York City.

Q: Where can we get a copy of this report?

A: Ariel Property Advisors’“Multifamily Year in Review 2017” and all of our research reports are available on our website at http://arielpa.nyc/investor-relations/research-reports.

Shimon Shkury is the founder and president of Ariel Property Advisors, New York, N.Y.