The strategic purchase – The bane of commercial property evaluation by Ferro

February 2, 2016 - Brokerage

Richard Ferro, Berkshire Hathaway Blake, Realtors

Unlike residential real estate, commercial real estate can present a particularly difficult challenge in determining an estimate of value because of something called a strategic purchase. In this situation, the property has an exceedingly high intrinsic value for reasons particular to a single purchaser. In the days of rapid drugstore expansion, signalized corner locations were a prime example. Another example is an adjacent property that can be a neighbor’s only option to increase the size and utility of his/her property, yielding a higher sale price that could be garnered from any other purchaser. Indeed, in the business world, there can be a host of reasons for the strategic purchase.

Knowledge of these situations is critical when using comparable sales to estimate value of a subject property, because it can skew one’s calculations. But the possibility of a strategic purchase also comes into play when the practitioner is discussing the asking price with a seller prior to marketing a new listing. Every seller’s worst nightmare is leaving money on the table. Because of this, the broker is challenged to determine a realistic asking price in order to market the property effectively, while addressing the seller’s desire for a price that can well be an unreasonable expectation.

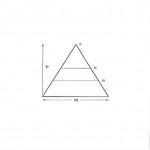

To incorporate the possibility of a strategic purchase, the use of the accompanying diagram can be of great benefit in discussions with a seller. “P” represents price and “M” represents the breadth of the market – the number of prospective purchasers who would be interested in the property at a given price. It is easy to demonstrate to the seller that as the price rises (comparing “a” price with the “b” price), fewer and fewer purchasers would be interested in their property. Point “c” represents that one purchaser who would pay an exceedingly high price – most likely for a strategic reason. With this visual aid, the seller is much more likely to see that such a probability is low at best and it could take an inordinate amount of time for that one buyer to come along.

Richard Ferro, CCIM is a principal broker and manager of Berkshire Hathaway Blake, Realtors, Albany, N.Y.

Unlike residential real estate, commercial real estate can present a particularly difficult challenge in determining an estimate of value because of something called a strategic purchase. In this situation, the property has an exceedingly high intrinsic value for reasons particular to a single purchaser. In the days of rapid drugstore expansion, signalized corner locations were a prime example. Another example is an adjacent property that can be a neighbor’s only option to increase the size and utility of his/her property, yielding a higher sale price that could be garnered from any other purchaser. Indeed, in the business world, there can be a host of reasons for the strategic purchase.

Knowledge of these situations is critical when using comparable sales to estimate value of a subject property, because it can skew one’s calculations. But the possibility of a strategic purchase also comes into play when the practitioner is discussing the asking price with a seller prior to marketing a new listing. Every seller’s worst nightmare is leaving money on the table. Because of this, the broker is challenged to determine a realistic asking price in order to market the property effectively, while addressing the seller’s desire for a price that can well be an unreasonable expectation.

To incorporate the possibility of a strategic purchase, the use of the accompanying diagram can be of great benefit in discussions with a seller. “P” represents price and “M” represents the breadth of the market – the number of prospective purchasers who would be interested in the property at a given price. It is easy to demonstrate to the seller that as the price rises (comparing “a” price with the “b” price), fewer and fewer purchasers would be interested in their property. Point “c” represents that one purchaser who would pay an exceedingly high price – most likely for a strategic reason. With this visual aid, the seller is much more likely to see that such a probability is low at best and it could take an inordinate amount of time for that one buyer to come along.

Richard Ferro, CCIM is a principal broker and manager of Berkshire Hathaway Blake, Realtors, Albany, N.Y.

Unlike residential real estate, commercial real estate can present a particularly difficult challenge in determining an estimate of value because of something called a strategic purchase. In this situation, the property has an exceedingly high intrinsic value for reasons particular to a single purchaser. In the days of rapid drugstore expansion, signalized corner locations were a prime example. Another example is an adjacent property that can be a neighbor’s only option to increase the size and utility of his/her property, yielding a higher sale price that could be garnered from any other purchaser. Indeed, in the business world, there can be a host of reasons for the strategic purchase.

Knowledge of these situations is critical when using comparable sales to estimate value of a subject property, because it can skew one’s calculations. But the possibility of a strategic purchase also comes into play when the practitioner is discussing the asking price with a seller prior to marketing a new listing. Every seller’s worst nightmare is leaving money on the table. Because of this, the broker is challenged to determine a realistic asking price in order to market the property effectively, while addressing the seller’s desire for a price that can well be an unreasonable expectation.

To incorporate the possibility of a strategic purchase, the use of the accompanying diagram can be of great benefit in discussions with a seller. “P” represents price and “M” represents the breadth of the market – the number of prospective purchasers who would be interested in the property at a given price. It is easy to demonstrate to the seller that as the price rises (comparing “a” price with the “b” price), fewer and fewer purchasers would be interested in their property. Point “c” represents that one purchaser who would pay an exceedingly high price – most likely for a strategic reason. With this visual aid, the seller is much more likely to see that such a probability is low at best and it could take an inordinate amount of time for that one buyer to come along.

Richard Ferro, CCIM is a principal broker and manager of Berkshire Hathaway Blake, Realtors, Albany, N.Y.