Shkury of Ariel Property Advisors shares highlights from multifamily market report

New York, NY The New York Real Estate Journal recently sat down with Shimon Shkury, founder and president of Ariel Property Advisors, an investment real estate services and advisory company, who shared key highlights from his firm’s newly released, “Multifamily Quarter in Review New York City: 2016.”

Q: We are midway through 2016, how is the New York City multifamily market fairing so far?

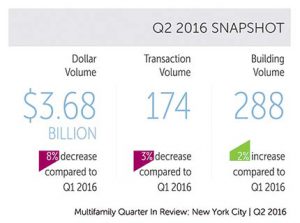

A: Overall, the multifamily market has had a positive 2nd quarter 2016 so far. Pricing is holding or up modestly throughout the city. Fewer transactions are taking place in the multifamily market, but dollar volume is up as a result of many institutional multifamily sales taking place. We are also seeing reluctance from small to mid-sized New York City property owners to sell because they cannot find investment properties that offer the same cash flow and the same future upside potential as their current holdings. For the 2nd quarter 2016, New York City saw 174 transactions comprised of 288 buildings totaling $3.681 billion in gross consideration. This represents a 17% increase in dollar volume, a 19% decrease in transaction volume and a 23% decrease in property volume compared to 2nd quarter 2015, which saw 372 properties trade across 216 transactions totaling $3.144 billion in gross consideration.

Q: What has been most surprising about the 2016 market so far this year?

A: At the start of 2016, many felt prices for New York City multifamily properties had peaked and, with interest rates starting to go up, would fall over the course of the year. Several macroeconomic factors, however, have continued to strengthen prices. Inconsistent economic growth has led the Fed to delay further interest rate increases. Global economic turmoil—most recently with the Brexit—has enhanced New York’s status as a safe-haven for capital even more. As a result, pricing throughout the city either held or showed slight appreciation by most measures. The average price per s/f in Brooklyn is now approaching $400 per s/f, compared to $300 a year ago. Average capitalization rates are down 60 basis points in The Bronx, and the average cap rate for each borough now sits at 5% or below. This trend is also supported by New York’s multifamily asset reputation as only strengthening. Due to global market uncertainty, New York City is frequently called a safe haven for investment and foreign capital. In essence, for the foreseeable future, we believe pricing for multifamily assets will continue to favor sellers.

Q: How was multifamily sales activity throughout the boroughs in the 2Q16?

Q: How was multifamily sales activity throughout the boroughs in the 2Q16?

A: Manhattan saw $1.628 billion in multifamily sales during the 2nd quarter 2016, which is on pace with figures seen during the 1st quarter 2016. Transaction volume was up as the borough saw 42 transactions across 68 buildings, which represents a 42% increase in transaction volume and a 51% increase in building volume compared to 1st quarter 2016. The most active neighborhood in the city was the East Village with 13 buildings trading across nine transactions.

Brooklyn experienced an uptick in multi-property portfolios this quarter, as 90 buildings traded across 54 transactions for $807 million in gross consideration. Three trades of six or more properties, each in the $30-$50 million range, took place. Two of these took place in Crown Heights, for an average of $388 per s/f. Despite this cluster of activity, Williamsburg has been the most active neighborhood so far this year, with over $300 million in gross sales, and an average price per s/f of $850, a figure which rivals many prime neighborhoods in Manhattan.

Northern Manhattan saw several institutional-caliber sales that generated an uptick in dollar volume despite a slight downturn transaction volume. The submarket saw 26 transactions across 42 buildings, totaling $666.387 million in gross consideration, which represents a 45% increase in dollar volume and a 48% decrease in building volume compared to 2nd quarter 2015. One leading transaction for the quarter was The Aspen, aka 1951-1965 1st Ave. in East Harlem, which was purchased by Clipper Equity. With a $165 million sale of a nine-building portfolio, Washington Heights was the most active neighborhood for multifamily sales in the 2nd quarter 2016.

Bronx multifamily prices continued to advance even though sales volume pulled back in the 2nd quarter 2016. The borough saw 36 transactions across 62 buildings totaling $334 million in gross consideration during the quarter, which represents a 29% decline in transaction volume, 21% decline in building volume, and 30% decline in dollar volume from 2nd quarter 2015. Small to mid-size transactions dominated the quarter. One example is the recent purchase of 3300-10 Palmer Ave., a 135-unit rental complex that sold for $24.6 million, or $177 per s/f. The borough saw 16 trades across 26 buildings, and $245 million in gross consideration. Dollar volume was up 43% year-over-year and the number of units traded nearly doubled, from 577 to 1,088.

Q: What do you see on the horizon for the multifamily market this year?

A: We believe 2016 will continue to be a very active year for multifamily sales and financing. Multifamily assets are well positioned to benefit the most from the market volatility that leads investors to seek out safety. New York has big positive changes that will begin to launch towards the end of the year and therefore give us great optimism heading into 2017. Noteworthy examples include the Second Ave. Subway opening, which we are seeing priced in a more pronounced way on recent listings including the East 83rd St. portfolio as well as 1750-1752 Second Ave. in Upper Manhattan. Additionally, the first phase of Columbia University’s expansion will be a boon to property values uptown.

Q: Are there are any concerns you see in the foreseeable future?

A: In the short-term we are keeping an eye on several thousand units coming to market in Brooklyn at the end of the year. This may put a damper on Brooklyn’s rental market, but long-term we are big believers in borough prospects because of the improved quality of life. Dumbo Heights for example will continue to fuel residential demand in the long-term.

Shimon Shkury is president at Ariel Property Advisors, New York, N.Y.