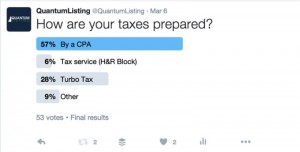

Perlmutter Properties Inc., my real estate brokerage, does a lot of work with Cushman & Wakefield’s Retail Services Group on the H&R Block account, so, I was also interested from that perspective. Unlike lawyers, who are only supposed to ask questions to which they already know the answer, I had no idea what the answer would be to this month’s Quantum Query, “How are your taxes prepared?”

We had 53 responses to the poll. The possible answers and results were:

• By a CPA 57%;

• Tax service (i.e. H&R Block) 6%;

• Turbo Tax 28%; and

• Other 9%.

I would have expected the number of responses for H&R Block to be higher. According to their website, they have 12,000 offices and prepare over 24 million tax returns. There are approximately 124 million households in the U.S. Therefore, if the poll respondents were representative of the U.S. as a whole, one might have expected closer to 19% to select H&R Block as the answer.

Looking at the demographics of the QuantumListing followers on Twitter, though, we begin to see why. Only 15% of the followers have household income below $100,000. The plurality are white-collar workers, professionals, or self-employed. 78% are into premium brands. The data suggests that QuantumListing Twitter followers are not living paycheck to paycheck, and possibly have more complex tax returns that they feel more comfortable bringing to a CPA than a storefront. At 28%, there are a surprisingly high number of respondents that use Turbo Tax or other software to prepare their taxes.

Interestingly, H&R Block recently started Block Advisors, geared at higher net worth individuals and small businesses. Perlmutter Properties Inc. has been working with C&W on some of these offices recently. So, if were to conduct a similar poll in a couple of years with the same audience, the results might be different.

David Perlmutter is the owner of QuantumListing/Perlmutter Properties, White Plains, N.Y.