Ariel Property Advisors releases “Bronx 2015 Year-End Sales Report”

February 16, 2016 - Brokerage

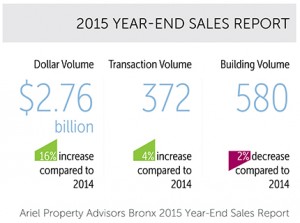

Bronx 2015 End-Year Snapshot.

The Bronx investment property sales market saw considerable growth in terms of dollar volume and price appreciation in 2015, according to Ariel Property Advisors’ “Bronx 2015 Year-End Sales Report." While multifamily sales volume held relatively steady from 2014 levels, there was a notable surge in sales of commercial, development and special purpose transactions.

In 2015, The Bronx saw 372 transactions consisting of 580 properties totaling approximately $2.767 billion in gross consideration. This represents a significant 16% increase in dollar volume despite a modest 4% increase in transaction volume and a 2% decrease in property volume compared to 2014, which saw 356 transactions consisting of 590 properties for approximately $2.392 billion. Sales activity picked up considerably in the latter half of 2015 as $1.5 billion worth of sales were reported, representing a 30% increase over the same period in 2014.

"Several institutional investors and developers have recognized the Bronx for its great potential of untapped growth opportunities," said Jason Gold, vice president at Ariel Property Advisors, "In 2015, an increased presence of institutional players, which included Extell Development, Vanbarton Group, Savanna and Chetrit Group/Somerset Partners, flocked to the Bronx to execute a variety of projects which will have a long lasting impact on the boroughâ€

The borough continued to see steady, consistent price increases across all product types. Multifamily buildings soared past $160 per square foot and average gross rent multiple hit 10 times, a level that was surpassed in several instances. For example, 865 Walton Ave., a mixed-use apartment building within the Lower Concourse District, sold for over $16.425 million, which is more than 15 times the gross rent. Another mixed-use property located at 649, 650 and 690 Allerton Ave. in Bronx Park East sold for $34.3 million, which represents over $200 per s/f and roughly 12 times the gross rent.

"Multifamily pricing in the Bronx continues to strengthen due to an increased demand from institutional investors," said Scot Hirschfield, vice president at Ariel Property Advisors. "These investors have come from all over the world to the Metropolitan area to capitalize on the rising GRM's and compressed cap rates."

The western half of The Bronx saw the vast majority of transactions take place, accounting for 75% of sales activity. The Fortress and Continental Portfolios, whose combined value exceeded $200 million, included properties throughout the western Bronx neighborhoods such as Concourse, Mount Hope, Fordham Heights and Bedford Park.

Bronx development site sales also had a strong year as dollar volume grew 63% year-over-year to $379.5 million across 87 transactions. Prices also appreciated considerably—the average price per build able s/f climbed to $60, a 33% increase from the prior year.

A rising number of institutional developers made their first investments in the borough in 2015. Extell, a prominent Manhattan based developer, made their first purchase in The Bronx with their acquisition of 2505 Bruckner Bvd. for $41 million. The Lightstone Group purchased 917 Ogden Avenue, a 39-unit apartment building in Highbridge, marking the national real estate investment company’s first multifamily acquisition in the borough.

See the full report here:Â

http://arielpa.com/report/report-APA-Bronx-2015-Sales-Report