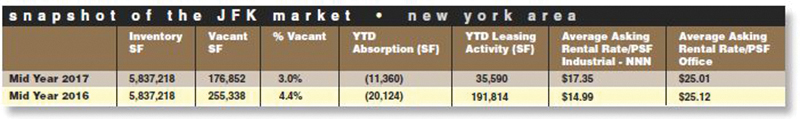

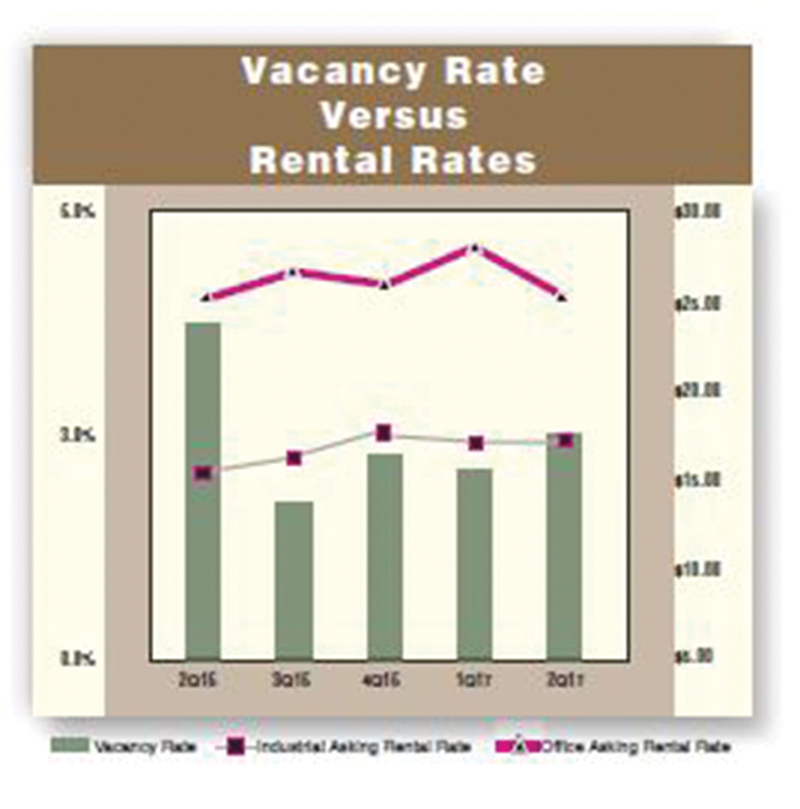

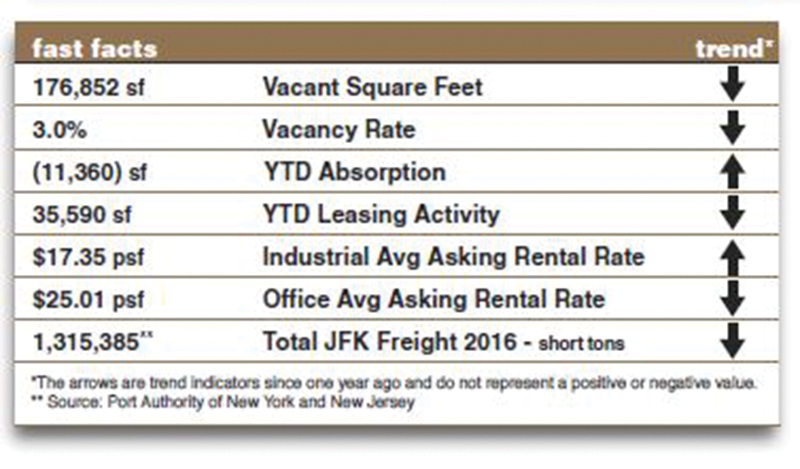

With virtually no significant vacant space returning, the JFK Airport Market continued to tighten through MY17. Availability diminished from 255,338 s/f at MY16, to 176,852 s/f at MY17 with the vacancy rate declining from 4.4% at MY16 to 3.0% at MY17.

With marginal space available in the JFK Core Market (69,467 s/f), the vacancy rate reached a low of 1.6% at MY17, dropping from 3.1% year-over-year. Asking lease rates remained stable with industrial properties at averaging approximately $17 NNN per s/f. Office asking rents averaged $25 per s/f. A supply of warehouse space in the Core JFK Market (Jamaica) is expected to become available, including several units over 10,000 s/f each and as a result, asking rents should rise.

With marginal space available in the JFK Core Market (69,467 s/f), the vacancy rate reached a low of 1.6% at MY17, dropping from 3.1% year-over-year. Asking lease rates remained stable with industrial properties at averaging approximately $17 NNN per s/f. Office asking rents averaged $25 per s/f. A supply of warehouse space in the Core JFK Market (Jamaica) is expected to become available, including several units over 10,000 s/f each and as a result, asking rents should rise.

Due to limited space on the market, year-to-date leasing activity was lackluster, at 35,590 s/f, compared to 191,814 s/f a year ago. Several lease transactions included: 9,200 s/f to Bluebird Express at 145 Hook Creek Blvd. in Valley Stream, 8,000 s/f to DNJ Logistics at 147-48 182nd St. in Jamaica, and 7,750 s/f to Apex Global at 145-35 226th St. in Springfield Gardens. Additionally two notable moves occurred; Gold Market Bakery into 25,000 s/f at 95 Inip Dr. in Inwood, and CEVA Logistics into approximately 50,000 s/f at 230-39 International Airport Center Blvd. in Springfield Gardens.

Due to limited space on the market, year-to-date leasing activity was lackluster, at 35,590 s/f, compared to 191,814 s/f a year ago. Several lease transactions included: 9,200 s/f to Bluebird Express at 145 Hook Creek Blvd. in Valley Stream, 8,000 s/f to DNJ Logistics at 147-48 182nd St. in Jamaica, and 7,750 s/f to Apex Global at 145-35 226th St. in Springfield Gardens. Additionally two notable moves occurred; Gold Market Bakery into 25,000 s/f at 95 Inip Dr. in Inwood, and CEVA Logistics into approximately 50,000 s/f at 230-39 International Airport Center Blvd. in Springfield Gardens.

Investment activity included Malachite Group’s acquisition of a three building office portfolio totaling 71,750 s/f in the Core JFK Market.The properties were purchased from Seagis Property Group for $9.35 million in April.

Global Air Transport Industry Trends*

Robust demand in global air trade yielded a 12.7% increase in air freight tonne kilometers (FTKs) year-on-year in May 2017. Worldwide air freight volume rose significantly by 10.2% YTD through May as international freight volumes increased by 11.4%. Cargo volumes rose across most regions, notably Middle East carriers reported 8.5% growth while Asia Pacific carriers increased 10.9%. North American carriers were up 13.1% and European carriers reported a 13.4% increase.

*Source: The International Air Transport Association (IATA). IATA reports freight volume in Freight-Tonne-Kilometers.

Joann Saul is the market research administrator at the Rochlin Organization, Melville, N.Y.