Northmarq secures $77 million refinance of four properties

Melville, NY Ernest DesRochers, Charles Cotsalas, and Robert Delitsky of Northmarq’s New York and Long Island debt/equity team arranged $77 million in refinancing for four properties located in Melville, Brooklyn, and Garden City. Northmarq structured permanent fixed-rate loans for the borrowers through its network of correspondent life company relationships.

The properties represent class-A assets in their respective submarkets with underlying property economics and top-notch local sponsorship. The borrowing entities were sponsored by groups with whom Northmarq has had long-standing relationships. Northmarq’s correspondent lenders recognized theses strong attributes and provided financing structures that met client expectations.

445 Broadhollow Rd. is located in Melville. Built in 1981 and recently renovated in 2021, the 4-story, class-A office building totals 273,103 s/f. The $32 million fixed-rate, non-recourse loan a 10-year term with a 25-year amortization schedule.

345 Adams St. is located in downtown Brooklyn, and was constructed in the mid-1920s. The 13-story/34,668 s/f class-A retail condominium is located at the corner of Adams and Willoughby St. The $18 million fixed-rate, non-recourse loan is structured on a 10-year term with a 30-year amortization schedule.

801 Axinn Ave. is located in Garden City. Built in 1963 and fully renovated in 2022, the class-A, single tenanted office building totals 29,565 s/f. The $7 million fixed-rate loan is structured on a 21-year term with 2 years interest only followed by a 28-year amortization schedule.

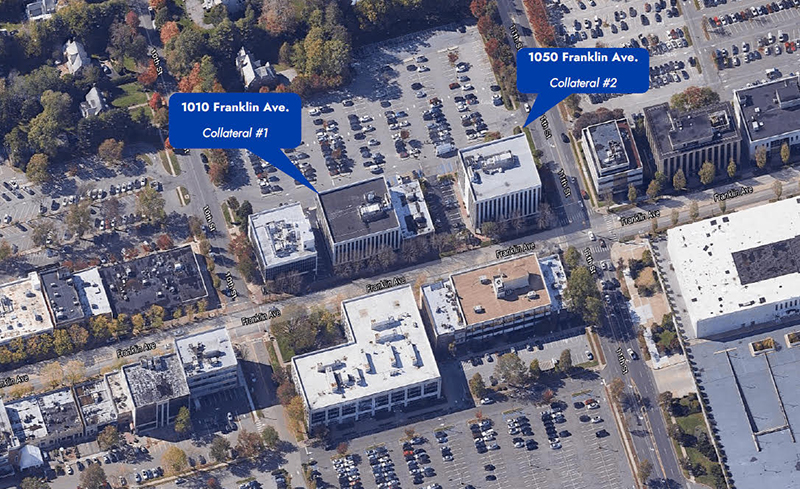

1010 and 1050 Franklin Ave. are located in Garden City. Situated on a 1-acre lot, the class-B sister office buildings total 111,674 s/f. The $20 million fixed-rate loan is structured on a 15-year term with a 30-year amortization schedule.

Suffolk County IDA supports expansion of A&Z Pharmaceuticals

The evolving relationship of environmental consultants and the lending community - by Chuck Merritt

When Environmental Site Assessments (ESA) were first part of commercial real estate risk management, it was the lenders driving this requirement. When a borrower wanted a loan on a property, banks would utilize a list of “Approved Consultants” to order the report on both refinances and purchases.

.gif)

.jpg)